R&D Tax Credit programmes are vital tools used by governments to incentivise business innovation. About 34 of 38 OECD countries provide favourable tax treatments for R&D, recognising the role of innovation in trade, economic growth, and global competitiveness.

The Purpose of R&D Tax Credits

Countries use R&D incentives to:

- Foster innovation and global competitiveness.

- Attract and retain skilled talent.

- De-risk innovation, especially for SMEs.

- Provide accessible funding alternatives to grants.

Countries compared:

- Ireland

- France

- Germany

- Netherlands

- US

- UK

One factor complicating the business environment is the geopolitical impact of the United States turning inward to produce more goods and services on its own. However, this does not mean the U.S. does not wish to engage in global trade. The U.S. wishes to realign its trade with other countries, and this provides an opportunity.

No country wishes to be less competitive or innovative. It is arguable that now, more than ever, countries need to be more innovative and bring new products and services to both national and international markets. Therefore, many businesses that intend to sell to global markets factor in the above dynamics.

What Makes a Good R&D Programme?

Features of an Effective R&D Tax Credit Programme

- Increases R&D spending beyond business-as-usual.

- Promotes employment in high-skill sectors.

- Balances compliance with accessibility.

- Delivers a solid return on public investment.

Studies show that R&D tax support yields a multiplier effect, with €1 of tax support generating €1.4 of additional R&D expenditure. However, the benefits vary across industries and firm sizes.

The following are some recent findings from economic studies done on R&D Tax Credits:

- Increased R&D Investment: Many studies confirm that the Tax Credits have been successful in encouraging increased R&D investment by firms, particularly small and medium-sized enterprises (SMEs). For example, in 2022, the OECD reported that 1 unit of R&D tax support resulted in 1.4 units of additional R&D for that unit of R&D spend.

- Disparities in Impact: There is evidence that the benefits of the R&D Tax Credits can vary significantly across different industries and company sizes. For instance, tech-focused sectors might see more direct benefits compared to others.

- Innovation Outcomes: While there is a general positive correlation between R&D spending and innovation output, the direct causal link between Tax Credits and specific innovation metrics (like patents) can be more complex and less straightforward.

- Economic Impact: Some evaluations suggest that while the R&D Tax Credits are effective at stimulating investment, the overall economic return on the government’s investment in the programme can vary and depends on the efficiency of the implementation and the characteristics of the recipient firms.

It is also important to note that all R&D Tax Credit programmes have a deadline by which to file an R&D Tax Credit claim. These deadlines vary from country to country.

Comparison of R&D Tax Credits Among Selected Countries

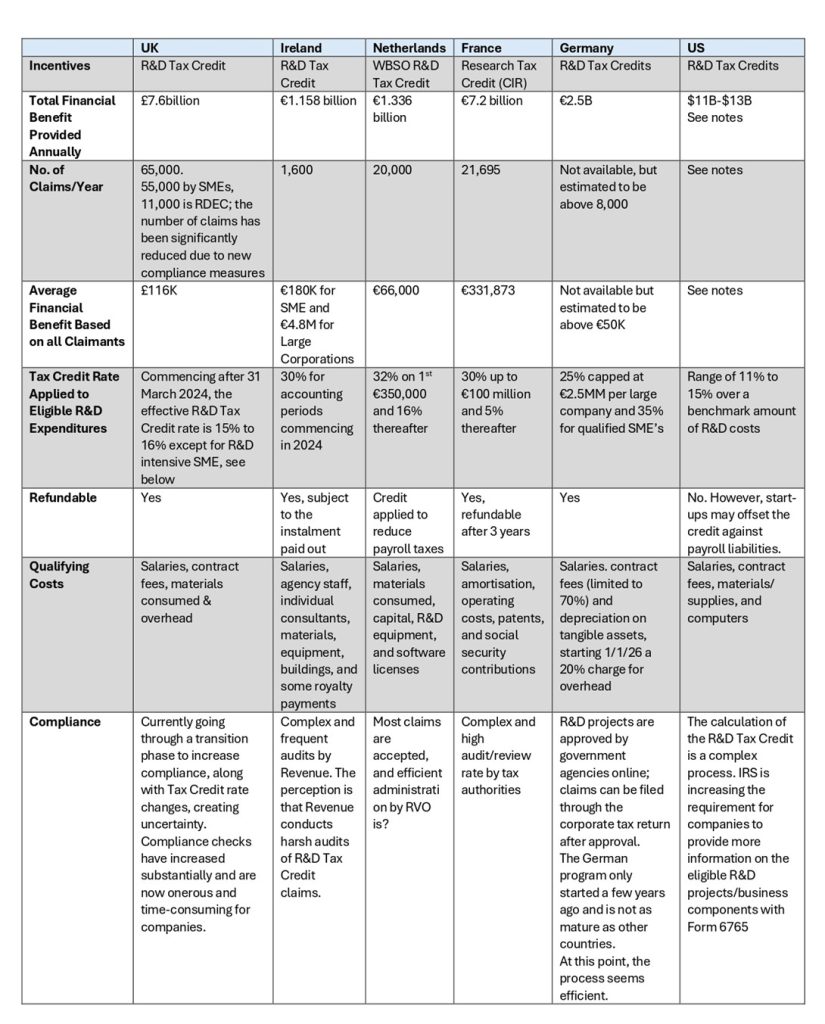

The table below compares the R&D Tax Credit incentives in Ireland, the U.S., France, Germany, the Netherlands, and the UK.

Table 1: A Comparison of R&D Tax Credits between Selected Countries

Key Takeaways:

- The statistics for each country are taken from the 2022 tax year, with the Tax Credit rates updated to 2024 where changes have occurred and the statistics are available. The IRS does not provide current statistics regarding the number of annual R&D Tax Credit claims or the average amount of R&D Tax Credit approved. The total financial benefit is an estimate taken from various papers.

- There is a wide discrepancy between countries as to the type of expenditures that qualify as R&D. All countries permit salaries and contract fees incurred in that particular country. This reflects the importance of driving talent and skilled employment as a government policy. Ireland has the widest range of expenditures, which also includes materials, plant, machinery, and buildings.

- The Frascati Manual is an internationally recognised document that contains a definition of Research and Development. Virtually all countries that have an R&D Tax Credit programme use some form of this definition.

- Essentially, the definition has 3 criteria that must be met for an eligible R&D Tax Credit project to take place.

- Technological Uncertainty

- Technological Advancement

- Systematic Investigation

UK R&D Tax Credit Programme

Over the past few years, the UK R&D Tax Credit programme has undergone substantial changes. HMRC was very concerned that a large number of R&D Tax Credit claimants were filing R&D Tax Credits in error. In short, HMRC believed many claims filed did not meet the definition of an eligible R&D Tax Credit project.

Recent reforms have merged SME and large company schemes. New rates (effective 2023):

- Standard R&D Tax Credit: 15% to 16.2%

- R&D-intensive loss-making SMEs (≥30% R&D spend): up to 27% refundable Tax Credit

Changes:

- Foreign contractor fees no longer eligible (effective for accounting periods commencing after April 1st, 2024)

- Data and software costs are now eligible

- Enhanced compliance and pre-notification requirements

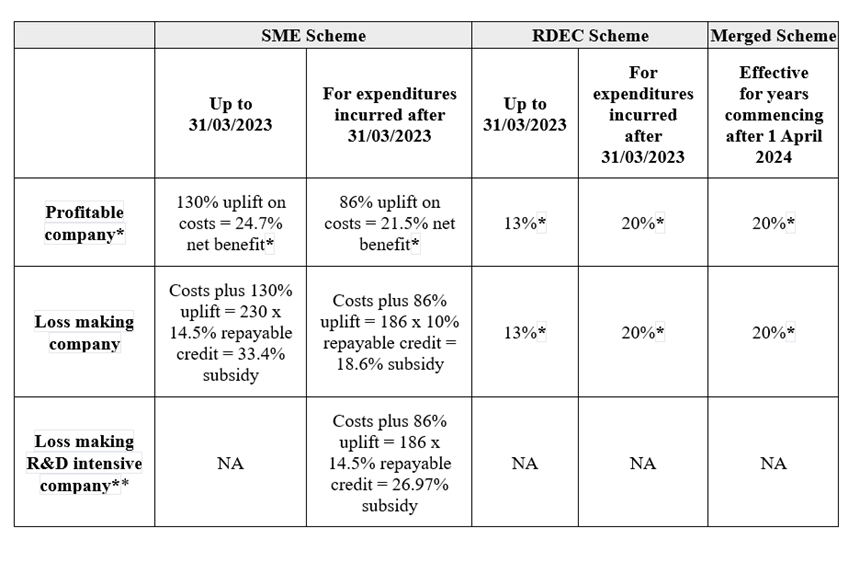

Below is a summary of the R&D Tax Credit rate changes in the UK over the past years.

Table 2: R&D Tax Credit Rate Changes – UK

* The R&D Tax Credits earned are subject to tax. The post-tax RDEC/Merged scheme rates from April 1st, 2023, will vary, depending on the level of the taxable profits a company has, and the corporation tax rate applied to those profits. The net RDEC tax benefit is 15% (after reducing the 20% R&D Tax Credit by the main rate of Corporate Tax of 25%). For SMEs, the net tax benefit is 16.2% (after applying the deemed corporate tax of 19%), and for companies paying tax in the marginal rate band, the net benefit is 14.7% (after applying the corporate tax rate of 26.5%).

**The loss-making R&D-intensive companies are those whose qualifying R&D expenditure is at least 40% (from April 1st, 2023) or 30% (from April 1st, 2024) of the total expenditure (splitting accounting periods, as required). The total expenditure for this purpose will be calculated from the total expenses figure in the profit and loss (P&L) account, subject to some adjustments.

Germany’s R&D Tax Credit Programme

Under the Research Allowance Act (Forschungszulagengesetz – FZulG), Germany provides a taxable R&D credit on eligible R&D expenses (up to a maximum annual benefit of €2.5 million for large companies and 3.5 million for SMEs). The credit is fully refundable, meaning businesses with no tax liability can receive a cash reimbursement.

Germany’s Research Allowance Act provides a tax credit/reimbursement of:

- 35% for SMEs

- Fewer than 250 people and have an annual turnover of less than 50 million euros, or whose annual balance sheet sum is a maximum of 43 million euros (noted linked companies need to be considered in this calculation).

- 25% for large firms

Annual caps: €3.5M (SMEs), €2.5M (others). Eligible costs include:

- R&D wages for R&D employees, employer-paid social security contributions

- 70% of contract research costs

- Depreciation of capital assets (recent addition)

In 2026 companies will have to add in an overhead surcharge equal to 20% of eligible costs.

Approval from the Bescheinigungsstelle Forschungszulage (BSFZ) is required, before claiming the credit on your corporate tax return.

Germany only brought in its R&D Tax Credit programme a few years ago, but it is now an extremely competitive and generous programme among EU countries.

France’s R&D Tax Credit Programme

France offers the Crédit d’Impôt Recherche (CIR), one of the most generous R&D tax incentives in Europe.

- Crédit d’Impôt Recherche (CIR): 30% (up to €100M), with a reduced rate of 5% for expenses exceeding this threshold

- Crédit d’Impôt Innovation (CII): 20% for SMEs (up to €80,000)

Costs include salaries, subcontracting, materials, and depreciation. While generous, the refund process is slow, and audits are rigorous. Companies can monetize credits via factoring.

To claim the CIR or CII, your business must report qualifying expenses on its corporate tax return and, if requested, provide supporting documentation to the French tax authorities (DGFiP).

United States R&D Tax Credit Programme

- 20% of incremental QREs (or 14% via simplified method)

- Effective benefit: 6–10%

Eligible costs:

- Wages

- Supplies

- Contract research

- Cloud computing

Small startups may offset payroll taxes. The credit is non-refundable but can be carried forward for 20 years. Many U.S. states offer additional credits.

The U.S. is by far the lowest R&D Tax Credit rate compared to other countries in this analysis.

Ireland’s R&D Tax Credit Programme

As of 2024:

- R&D Tax Credit rate: 30% (was 25%)

- Full refunds for claims ≤€50K (increased to €75K in 2025) otherwise instalments of refundable credits paid out over 3 years

Eligible costs:

- Salaries

- Contractors

- Agency staff

- materials

- Equipment and buildings

90-day Pre-notification required for new claimants (no claims in past 3 years). Revenue reviews are frequent and often involve third-party experts.

Netherlands R&D Tax Credit Programme

The Dutch WBSO programme offers:

- 32% credit on eligible costs up to €350K, then 16%

Only salary costs (excluding contractors) are eligible. The credit offsets payroll taxes. Approval from RVO is required before submitting corporate tax returns.

Compliance

Success hinges on effective administration. Overly aggressive audits discourage eligible businesses. Conversely, lax enforcement encourages abuse.

The recommended compliance review rate should be 10–20% of claims.

- UK: Under-enforcement led to widespread errors; HMRC has since escalated scrutiny and reduced credit rates.

- Germany/Netherlands: Require pre-approval and project certification.

- France/Ireland/US: No mandatory pre-approval, but audits are common.

Conclusion

All countries reviewed have well-established R&D Tax Credit programmes except Germany, which only recently implemented its scheme. Credit rates (2024):

- US: 6–10%

- UK: 15–16.2% ( 27% for R&D intensive SMEs in tax loss)

- Germany: 25–35%

- Ireland: 30%

- Netherlands: 32%

- France: Up to 30% (with some additional credits for innovation)

Noteworthy points:

- Ireland has comparable Tax Credit rates, permits the widest categories of costs to be claimed but the risk of a revenue audit is relatively high

- France has a larger Tax Credit; the refund takes much longer to obtain. There is also a great deal of concern over the audits by tax authorities

- The UK now requires additional R&D project and cost information to be submitted, and frequent policy changes introduce uncertainty

- Germany and the Netherlands (has a higher tax rate) offer structured, pre-approved compliance systems

- The US now requires certain R&D Tax Credit information to be submitted with Form 6765, which is included in the corporate tax return

Despite differences, R&D Tax Credits remain a crucial fiscal tool for driving innovation and economic competitiveness across all these jurisdictions.

Other relevant comments are as follows:

The OECD, which monitors the effectiveness of R&D Tax Credit programmes in countries that have such programmes in place, recommends against frequent policy reversals as they can minimise the impact of such policies on private R&D expenditure. To minimise uncertainty, it is therefore important that governments avoid making frequent changes to such policies.

Overall, however, it appears that R&D Tax Credit programmes will likely continue as a government fiscal tool to incentivise companies to create new or improved products and processes through R&D efforts. If you are interested in learning more about R&D Tax Credit programmes, please contact us.

RDP Associates is an international R&D Tax Credit firm that has assisted companies in preparing their R&D Tax Credit claims since 1987. For more information, visit www.rdpassociates.com or to discuss further, please contact Jenni Little on +44 (0)208 214 1341 or jlittle@rdpassociates.com